What is a T4?

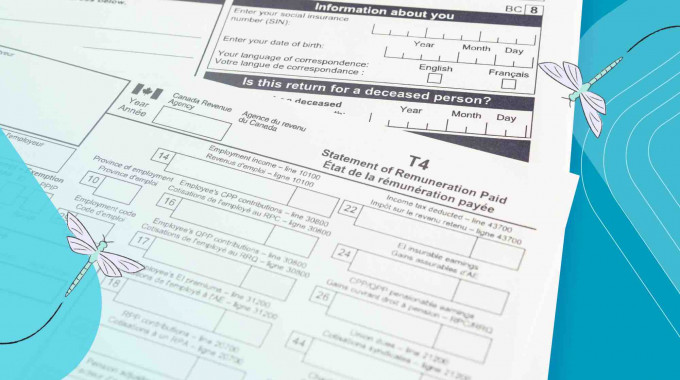

Also known as a Statement of Remuneration Paid, a T4 is a tax slip that lists how much employment income you’ve earned as a salaried employee. It also shows payroll deductions such as Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, Registered Retirement Savings Plan (RRSP) contributions, union dues, vacation pay, and more.

Employers are required by law to issue T4s for the preceding calendar year for current and former employees who have earned at least $500 or had deductions withheld. T4s must be issued by the end of February. This tax slip is essential for filing your taxes, so make sure you have yours before starting your tax return.

If you work as a freelancer or independent contractor, your clients may give you a T4A Statement of Pension, Retirement, Annuity, and Other Income. The T4A lists the dollar amount paid for each project or job and is used to help you calculate how much tax you owe. Unlike T4s, companies aren’t required to issue T4As so you may not always receive them. Since you’re running your own business, it’s wise to keep track of your earnings instead of relying on T4As. You’re also responsible for reporting all self-employment income on Form T2125 during tax time.

How To File Your Taxes Using Your T4

When an employer issues you your T4, these forms are also issued to the CRA. Whether you’re filing the taxes yourself by using tax software or with a tax professional, you can connect directly to your CRA account and auto-fill the information. This makes it easier to file your taxes and make sure your information is accurate. When using tax software, you also get detailed instructions on what information you need to enter to file your taxes.

That said, you can also use the form to fill in the tax forms manually. However, even though you aren’t sending this form to the CRA, it’s still important that you keep it. You could end up needing this information for tax purposes or to access your CRA account from previous years.

How To Recover Old Or Lost T4’s

There are two ways to obtain old or misplaced T4s-your employer or the CRA.

You can ask your current or former employers for a copy of your T4 for the current tax year or previous years. Employers must keep paper and electronic records on file for six years.

You can also access your T4 online through the Canada Revenue Agency (CRA) through My Account for Individuals. This secure portal lets you view and manage your income tax and benefit information in a few clicks. It also stores original and amended tax slips issued by employers, administrators, and Service Canada for up to ten years.

Registering for an account involves two steps: filling in personal information and then inputting a security code which is mailed to your address or emailed to you once you call the CRA to verify your identity.

After logging in, you’ll find a section titled “tax information slips” under related services. Select a tax year and T4 from the dropdown menus and then click next to see a list of tax slips for that tax year. Although there is no PDF download option, you can still print out the T4 as it appears on the page. If there are missing slips, you’ll need to reach out to your employer. If the company has gone out of business or cannot issue you a T4, contact the CRA for assistance.

You can also ask the CRA to mail you a paper copy of your T4 by calling the individual enquiries line at 1-800-959-8281. The CRA agent will need to verify your identity first, so make sure you have your Social Insurance Number (SIN), name, date of birth, and address on hand.

Sometimes, the CRA asks questions related to previous tax returns. This may be challenging if you haven’t filed for a long time. In this case, ask the agent if they can use other personal information on file to identify you.

Other Tax Forms You Can Get From The CRA

Other tax slips and related documents you’ll find in your CRA account include:

- T4A Statement of Pension, Retirement, Annuity, and Other Income

- T4A(P) Statement of Canada Pension Plan Benefits

- T4A(OAS) Statement of Old Age Security

- T4E Statement of Employment Insurance and Other Benefits

- T4RSP Statement of RRSP Income

- T4RIF Statement of Income from a Registered Retirement Income Fund

- T3 Statement of Trust Income Allocations and Designations

- T5 Statement of Investment Income

- T5007 Statement of Benefits

- T5008 Statement of Securities Transactions

- T1204 Government Services Contract Payments

- T5013 Partnership Information Return

- RC210 Canada workers benefit advance payments statement

- RC62 Universal child care benefit statement

- RRSP contribution receipt

- TFSA records from financial institutions

How To Find Old Tax Returns

Besides tax slips, your CRA account also shows the last time you filed your taxes and stores copies of your old tax returns in the form of notices of assessment. After you file your taxes, the CRA issues a notice of assessment, which means your tax return has been received and processed.

The notice of assessment includes key information such as:

- tax year

- date the notice of assessment was issued

- how much you owe or get back as a refund

- total, net, and taxable income

- deductions and credits (e.g. tuition deductions, home office expenses)

- RRSP deduction limit for the upcoming tax year

Your notice of assessment is an important document, so it’s a good idea to print it off from your CRA account and keep it with your tax records.

How to Get A T4 from your Previous Employer

If you can’t get your T4 through the CRA or your online account, you may be wondering where can I find my T4 otherwise? Well, one of the easiest ways is to get it through your previous employer. While finding the tax slips online is usually the preferred method, your previous employer will have access to them as well.

Included in your T4 slips, you can find your employee paid premiums, the money paid on taxes for the current or previous year, as well as boxes with other numbers you may need. You may need to request this form if you don’t get it from the issuer by March. It’s important to note that any other deductions, such as charitable donations, won’t be found on your T4 and are found on a different form.

Filing Your Tax Return Without a Paper Copy of Your T4

While it is often preferred to have the paper copy of your T4, this isn’t always possible. Since the T4s also have to be filed with the CRA before they’re given to you, you can often upload them directly from your CRA My Account. This can be done with your account or with a tax software program.

Final Thoughts

Even if you no longer have a physical copy of your T4, this doesn’t mean that it’s lost for good.

The CRA receives these forms as well as you, so they normally have a copy of these forms. They can be accessed almost immediately using your CRA My Account, or you can request that a copy be sent to you. Either way, you’re able to get that information.

Along with old T4S the CRA keeps records of all other relevant tax information. This means you’ll have access to all of your tax documents using your CRA account. Even your old Notice of Assessments can be found here if you need access to them.